New to the United States? Here’s How to Establish Credit

Relocating to the United States can be exciting and rewarding, but it also brings challenges. One hurdle is establishing credit for the first time. Without a U.S.-based credit report it can be difficult to rent property, get utilities turned on, be hired for certain jobs, or get approved for a loan if you need one. It can even impact what you pay for certain types of insurance.

The good news is there are specific steps you can take to establish credit, and the process and rules are the same whether you’re a U.S. citizen or not. First things first:

- You need a social security number or an Individual Taxpayer Identification Number (ITIN). A social security number is accepted by all lenders. If your visa status allows you to get one, you can apply at your local social security office. If you’re not eligible for a social security number, some lenders will accept an ITIN; apply for that by filing Form W-7 with the IRS.

- Once you have a social security number or ITIN, begin gathering the information and documentation typically needed when you apply for credit. This includes a valid proof of identification such as a green card, driver’s license, or passport as well as employment and pay information, address where you live, and monthly rent amount. This is also a great time to establish a banking relationship if you don’t already have one which will be helpful in a number of ways.

Now you’re ready to begin building your credit. It usually takes about six months for enough information to be reported to the credit bureaus for a score to be generated. There are two main types of credit scores: a FICO® Score and a VantageScore®.

| FICO® | VantageScore® |

|

|

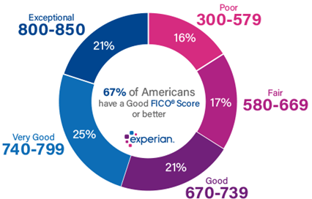

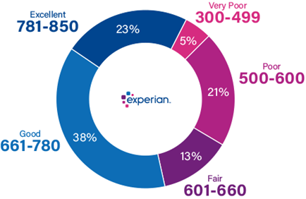

Scores usually range from 300 – 850, with categories of poor, fair, good, very good and exceptional.

Most lenders use the FICO Score when you apply for credit, but both scores are calculated in similar ways. It won’t happen overnight, but with a little patience you can establish a credit file and good credit score. Here are a few ways to do that:

- Check with your landlord to see if they report rent payments to the credit bureaus using a rent reporting service. Some do, and it helps to establish your file and score.

- Report your own rent and all utility payments to Experian (one of the three major credit bureaus) yourself using their Experian Boost service. It’s a free service that can help build your credit file.

- If you have a credit card in your home country from a card issuer with a global presence (e.g., American Express/Amex), request a United States credit card using your existing credit history with that card issuer.

- Ask to be added as an authorized user to a credit card of a trusted family member or close friend who has good money management habits. Depending on the card issuer’s policy, the payment history may be reported to the credit bureaus under your name too. However, if they don’t pay the bill on time, it will negatively impact you, so be very careful whose account you ask to be added to.

- Ask a trusted family member or friend with a good credit score to be a cosigner or co-applicant on a credit card or small loan application in your name. The cosigner or co-applicant’s credit may help you get approved.

- Apply for a secured credit card or cash secured loan. You deposit money into an account to secure it, and the bank puts a hold on the funds and “loans” you the same amount of money. Paying it back establishes a credit history.

- Apply for a student (if applicable), retail store, or gas credit card. Student, retail store, and gas credit cards are often easier to get approved for than traditional credit cards. Some retail stores (e.g., Target, Walmart, Home Depot or Lowe’s) allow you to make a purchase with their credit card and then pay it right back inside the store on the same day. This is a great way to establish a positive credit history without the risk of a late payment negatively impacting your credit score.

- Pay all bills on time, as 35% of your FICO credit score is based on your payment history. This is the most important tip in this article.

- Try to keep credit card balances low, as 30% of your score is how much you owe (less is better) compared to how much you earn. This includes the total available credit (the limit on your card or line of credit) and your current balance owed. This is the second biggest factor after #8.

It’s best to start small and work your way up. Going slow and steady ensures you will be able to manage using credit and making on-time payments, which will establish a positive credit score.

Adrienne Wilder is a group banking advisor for Pinnacle Financial Partners, based in Charleston, SC. She can be reached at (843) 576-1364 or adrienne.wilder@pnfp.com. Danny Wilson is the financial education program manager for Pinnacle Financial Partners, based in Nashville, TN. He can be reached at (615) 690-1434 or danny.wilson@pnfp.com.